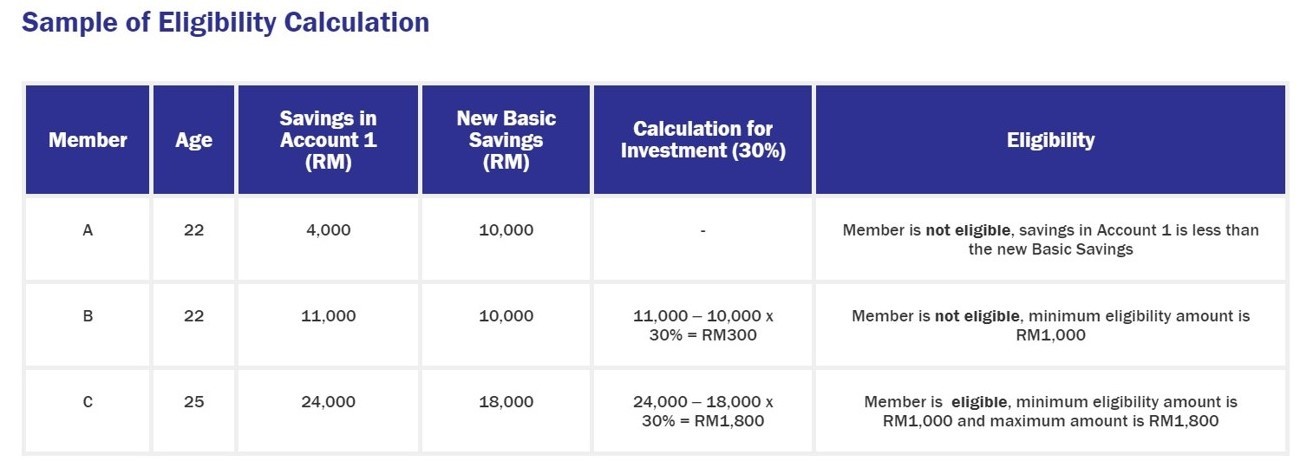

Accordingly members will now. You can then invest 30 as of 1 January 2017 from the excess of RM11000 which amounts to RM3300 into fund management which has institutions which has been approved by EPF.

Labour Ministry Notifies 8 65 Interest Rate On Epf For 2018 19 Interest Rates Growing Wealth Personal Finance

MoF bagged RM780m as middleman.

. Like Facebook Page Add Friend Follow me on. Top Recruiter Contest 2017 Dua Kali Champion Top Recruiter 2016 Like Facebook Page. Employees Provident Fund EPF is a retirement benefits scheme where the employee contributes 12 of his basic salary and dearness allowance every month.

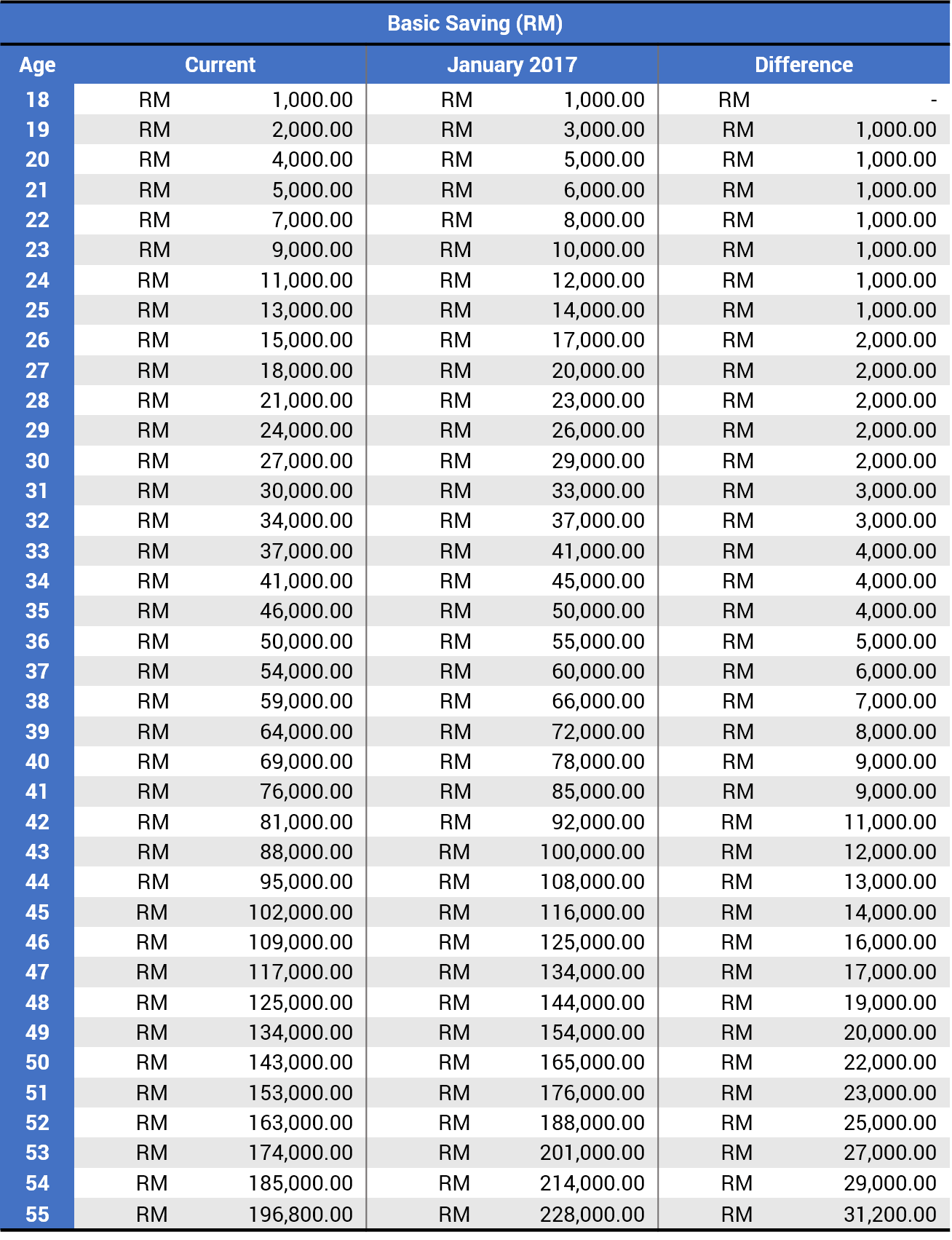

Like Facebook Page Add Friend Follow me on. EPF basic savings amount will be raised to reflect the higher cost of living come 2017. The amount will be set as the minimum target EPF basic savings members should have upon reaching age 55 the pension fund said in a statement today.

EPF revises basic savings quantum to RM240000 The Malaysian InsightThis is from the current RM228000 and will be effective January 1. Lets say youre 30 according to the basic savings set by EPF you should have at least RM29000. The Employees Provident Fund EPF is revising the quantum for basic savings from the current RM228000 to RM240000 effective Jan 1 2019.

The Employees Provident Fund EPF will revise upwards the Basic Savings quantum -- the minimum target savings that its members should have when they reach 55 -- from RM196800 to. Employee Provident Fund EPF is a savings scheme for retirement regulated by the Employees Provident Fund Organisation EPFO. Read the article to understand how this will affect you.

Take advantage of the higher 30 withdrawal limit for external investments to. Heres a rundown on how you can withdraw from EPF to invest in Members Investment Schemes and calculate potential gains or risk losses. New basic savings changes in 2019Heres a rundown on how you can withdraw from EPF to invest in Members Investment Schemes and calculate potential gains or risk losses.

KUALA LUMPUR Nov 28. Source Free Malaysia Today. EPF MIS Revised Basic Savings Table and Calculation April 18th 2019 - EPF MIS Revised Basic Savings Table and Calculation effective Jan 2017 Attention to all EPF members investment scheme MIS members EPF has just announced that they will revised the basic savings threshold before a member can withdraw for investment purpose effective Jan 2017.

You have RM40000 in Akaun 1 which means you have RM11000 in excess. The Employees Provident Fund EPF will be revising the quantum for Basic Savings from the current RM228000 to RM240000 effective Jan 1 2019. Basic Savings refers to the.

In view of the escalating cost of living longer life expectancy and higher inflation rate the EPF has made the decision to revise the basic. Of Malaysias 324 million population 39 million are poor. The employer also contributes an equivalent amount 833 towards EPS and 367 towards EPF in the employees accountThe employee can withdraw the accumulated corpus at the time of.

According to EPF the basic savings refer to the amount that is considered sufficient to support members basic retirement needs for 20 years from age 55 to 75 aligned with the Malaysian life expectancy. 1 day agoHis situation drove me to analyse our countrys social protection system. According to EPF the basic savings refer to the amount that is considered sufficient to support members basic retirement needs for 20 years from age 55 to 75 aligned with the Malaysian life expectancy.

Top Recruiter Contest 2017 Dua Kali Champion Top Recruiter 2016 Like Facebook Page. New basic savings changes in 2019. In view of the escalating cost of living longer life expectancy and higher inflation rate the EPF has made the decision to revise the.

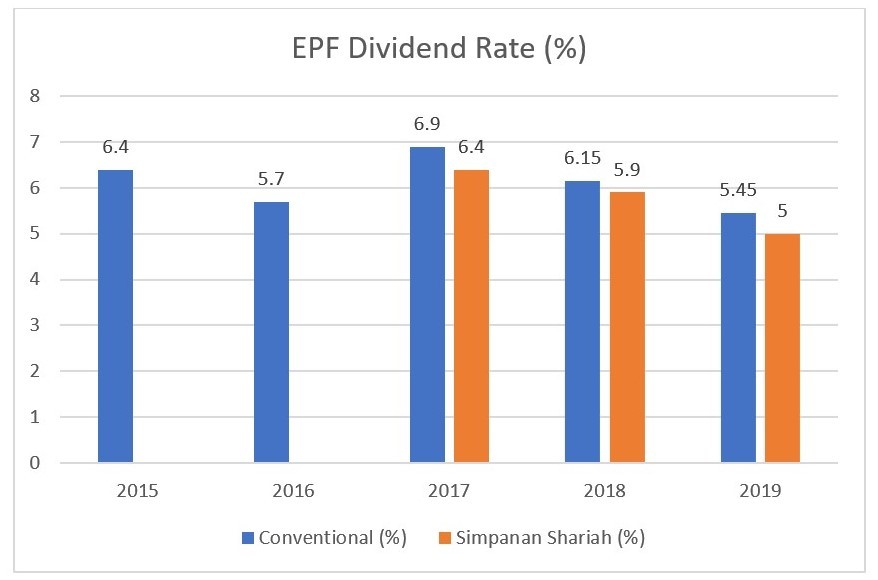

The Employee Provident Fund Organisation EPFO had reduced the interest rates on Employee Provident Fund EPF deposits 810 for FY 2021-22 from 850 in the Previous FY 2020-21. 20 rows EPF Head of Strategy Management Department Balqais Yusoff said. The basic savings represents the amount.

Starting Jan 2017 new EPF basic saving will be taking effect. Under this scheme the. Epf 412019 31500 AM.

Average Savings Of Epf Members At 54 Years Of Age Download Table

How To Diversify Grow Your Epf Savings Psst Tell Your Parents About It Too No Money Lah

What Does The New Epf Minimum Savings Mean To You

How To Diversify Grow Your Epf Savings Psst Tell Your Parents About It Too No Money Lah

Why Should You Withdraw Old Epf Account Balance In Operative Epf A C Timeline In 2021 Investment In India Personal Finance Accounting

Is Your Pf Balance Less Than Anticipation Anticipation Chartered Financial Analyst Financial Analyst

Financial Assets Savings Of The Households 2012 2018 Financial Asset Investment In India Investing

How To Do Epf E Nomination With Beneficiary Aadhaar Photo Investment In India News Online Stock Market Investing

Epf Dividend Table 2019 Dividend Life Insurance Policy Financial Instrument

Epf Withdrawal Education Finance Tips How To Apply

2 Statistical Summary Of Epf Return On Investment And Dividend Rate Download Table

2 Statistical Summary Of Epf Return On Investment And Dividend Rate Download Table

Snapshot Of 22 Popular Investment Options In India Investment In India Investing Economics Lessons

Average Savings Of Epf Members At 54 Years Of Age Download Scientific Diagram

Best Roc Compliance At Kolkata Public Limited Company Private Limited Company Bookkeeping Services

30 Nov 2020 Bar Chart Chart 10 Things

Pin By Mohdalif Yadi On Data Sijil Inbox Screenshot Data

Epf Historical Interest Rates Since Year 1952 Succinct Fp

How To Diversify Grow Your Epf Savings Psst Tell Your Parents About It Too No Money Lah